How to Fill Out W9 for OnlyFans: A Simple Guide for Creators

As an OnlyFans creator, knowing how to fill out tax forms correctly is crucial for getting paid. This article will walk you through each step of the W-9 form, ensuring you understand the process and avoid any payment delays.

Key Takeaways

Form W-9 is your golden ticket to getting paid on OnlyFans—don’t forget to fill it out, or the IRS might come knocking!

Accuracy is key: ensure your legal and business names match IRS records, and choose the right tax ID number to keep the taxman happy.

Submitting your W-9 isn’t just a checkbox—it’s a one-time pass that unlocks your payment potential with OnlyFans and keeps tax obligations at bay!

Why OnlyFans Creators Need a W-9 Form

If you're making money on OnlyFans, you’ll need to fill out Form W-9 before getting paid. Why? Because OnlyFans' payment processors are required to report your earnings to the IRS if you make $600 or more per year and are paid via direct deposit, wire transfer, or ACH.

This form provides your legal name, taxpayer identification number (TIN), and tax classification so that a 1099-NEC can be issued to you for tax reporting.

Without a completed W-9, OnlyFans may request your tax information. If you fail to submit it or provide an incorrect TIN, the IRS may require backup withholding at 24%, meaning OnlyFans' payment processors must withhold a portion of your earnings for taxes.

Submitting it upfront ensures you get paid in full and avoid tax-related issues later.

Think of it as an official paper trail that keeps both you and OnlyFans compliant with the IRS. It's a one-time form, so once it’s done, you’re good to go!

Essential Information Required on Form W-9

Filling out a W-9 form for OnlyFans tax reporting isn’t complicated, but you need to get a few key details right.

Legal Name & Business Name: Your legal name must match exactly what’s on file with the IRS and your own tax return. If you use a stage name or business name (DBA), you can include it in the business name section, but your legal name must be listed first to ensure accurate tax reporting.

Address: This is where the IRS (or OnlyFans' payment processors) will send any important tax documents, like your 1099-NEC, if you earn $600 or more and are paid via direct deposit, wire transfer, or ACH.

Taxpayer Identification Number (TIN): This can be your Social Security Number (SSN) if you're filing as an individual or an Employer Identification Number (EIN) if you operate as a business. While an EIN can help protect your SSN, it does not automatically qualify you for business deductions. Only those filing taxes as self-employed (Schedule C) can deduct business expenses.

Since OnlyFans' payment processors do not withhold taxes, you’re responsible for paying taxes on your own, including income tax and self-employment tax. That’s why providing accurate W-9 information is crucial—it ensures your income is reported correctly and prevents IRS issues.

Get these details right, and your W-9 will be smooth sailing—no delays, no tax-related headaches!

Step-by-Step Guide to Filling Out Form W-9 for OnlyFans Creators

Filling out a W-9 for OnlyFans is easier than you think—you just need to get a few details right. Here’s how to do it step by step.

1. Get the Form

First, download Form W-9 from either the IRS website (irs.gov) or directly from OnlyFans, if they provide it. It’s a simple one-page document, but don’t rush through it—accuracy matters.

2. Fill in Your Legal Name and Business Name

Your legal name must match exactly what’s on your tax return. If you use a stage name or a business name (DBA), put that under the "Business Name" section. This keeps things consistent for tax reporting.

3. Choose Your Tax Classification

For most OnlyFans creators, you’ll check “Individual/sole proprietor or single-member LLC.” This tells the IRS how you’re classified for tax purposes. If you have a different business setup, select the correct option.

4. Enter Your Taxpayer Identification Number (TIN)

You’ll need to provide either your Social Security Number (SSN) or an Employer Identification Number (EIN). If you’re running your OnlyFans account as a business, using an EIN can help protect your SSN from being shared unnecessarily.

5. Sign and Date the Form

At the bottom of the form, sign and date it to certify that all the information you provided is correct. If anything is wrong, the IRS might flag your payments, so double-check before submitting.

Once completed, upload it to OnlyFans, and you’re all set—no W-9, no payments, so don’t skip this step!

Avoiding Common Mistakes When Filling Out W-9

Filling out a W-9 for OnlyFans seems simple, but small mistakes can cause payment delays or tax headaches down the road. Here’s what to watch out for:

1. Mismatched Names

Your legal name on the W-9 must match exactly what’s on your tax return. If you enter a stage name or business name in the wrong section, the IRS could reject it. OnlyFans also uses this form to generate your 1099-NEC, so consistency matters.

2. Wrong TIN (Taxpayer Identification Number)

Your TIN is either your Social Security Number (SSN) or your Employer Identification Number (EIN). Using the wrong one can trigger IRS issues, so make sure you input the right number. If you’re using an EIN instead of your SSN, confirm that it’s registered under your name or business entity.

3. Forgetting to Sign and Submit

Sounds obvious, but many people forget this final step! Without a signature and date, the form is invalid, and OnlyFans won’t process your payments. Double-check before submitting, or you might have to go through the process again.

Filling out your W-9 correctly the first time saves you from unnecessary delays. Take a couple of extra minutes to review everything—it’s worth it to avoid IRS issues and keep your earnings flowing smoothly!

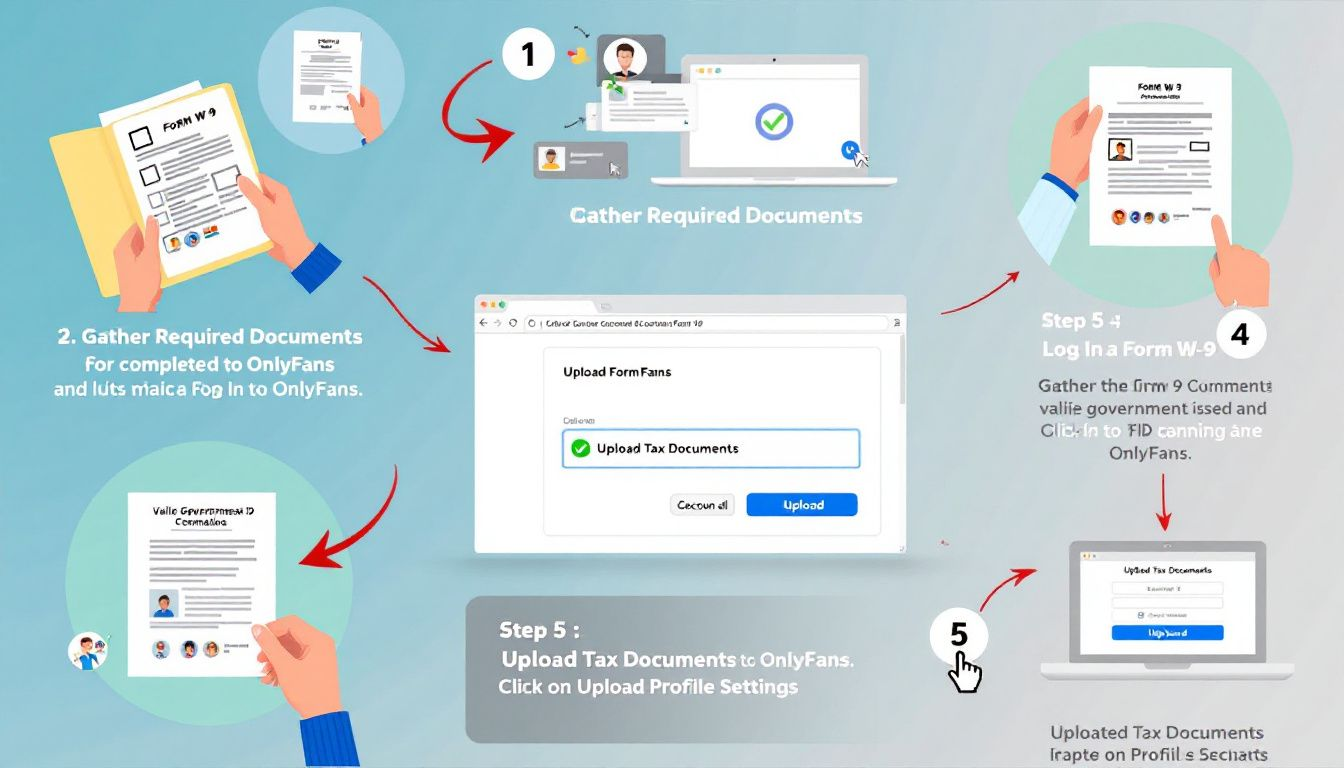

Submitting Your Completed Form W-9 to OnlyFans

Once you’ve filled out your W-9 form, the final step is submitting it to OnlyFans—and trust me, this part matters. Without it, your payments won’t be processed.

Where to Upload It

OnlyFans typically provides a secure place in your creator account settings to upload tax documents. If you can’t find it, check their official support page or contact their team. You can also download a digital W-9 form, fill it out, and upload it directly—no need for printing.

Why It’s Important

Submitting your W-9 before your first payout prevents delays, holds, or even IRS backup withholding (which can take 24% of your earnings). Getting it done correctly the first time means you get paid on time without hassle.

Double-check your details, upload the form, and you’re good to go—no W-9, no money, so don’t skip this step!

How Form W-9 Affects Your OnlyFans Taxes

Filling out a W-9 isn’t just a formality—it directly impacts how you report and pay income tax on your OnlyFans tax form earnings.

If you earn $600 or more in a year through direct deposit, wire transfer, or ACH, OnlyFans' payment processors will send you a 1099-NEC by January 31st summarizing your total income. The IRS gets a copy, so skipping taxes isn’t an option.

Since OnlyFans creators are considered self-employed, your earnings aren’t taxed upfront. That means you must set aside money for taxes, including income tax and self-employment tax (15.3%), which covers Social Security and Medicare.

You should also track business expenses if you plan to deduct them when filing taxes. However, OnlyFans tax write-offs are only available if you file as self-employed on Schedule C.

If you expect to owe over $1,000 in taxes after deductions and credits, the IRS requires you to make quarterly estimated tax payments (due in April, June, September, and January) to avoid penalties and a surprise tax bill.

Bottom line? The federal tax classification on your W-9 ensures your earnings are reported correctly. Plan ahead for your tax obligations—because the IRS will be watching!

Final Thoughts on Completing Your W-9 for OnlyFans

Filling out your W-9 for OnlyFans is a one-time task, but getting it right saves you from payment delays and IRS headaches.

Make sure your legal name, TIN (SSN or EIN), and tax classification are accurate. Don’t forget to sign and submit the form—no W-9, no payouts!

Keeping your tax documents organized helps you avoid penalties and makes tax season way less stressful.

If you earn $600 or more, expect a 1099-NEC for reporting. Do it once, do it right, and you’ll be set to focus on creating content—without tax worries!

Frequently Asked Questions (FAQs)

How do I fill out a W-9 for OnlyFans?

Download the form from OnlyFans or the IRS website, enter your legal name, business name (if applicable), TIN (SSN or EIN), and tax classification, then sign and date it. Double-check everything before submitting it through your OnlyFans account.

How do I declare OnlyFans income?

If you make $600 or more, OnlyFans will send you a 1099-NEC. Report this income on your tax return, usually on Schedule C (self-employed income) if you’re running it as a business.

What happens if I don’t have an EIN or SSN?

You must have a valid SSN or EIN to submit a W-9. If you don’t want to use your SSN, you can apply for an EIN for free on the IRS website.

How do I report my OnlyFans earnings on my taxes?

As an independent contractor, you’re responsible for income tax and self-employment tax (15.3%). File a Schedule C with your 1040 tax return, and if you expect to owe more than $1,000, make quarterly estimated tax payments to avoid penalties.